Published on July 8, 2008

Thorium Power

Peaceful Nuclear Energy with Low Waste

and Improved Industry Economics

Collin Stewart

4th Annual Growth Conference

July 9, 2008

2

Safe Harbor Statement

This presentation may include certain statements that are not descriptions of historical facts,

but are forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section

21E of the Securities Exchange Act of 1934. These forward-looking

statements may include the description of our plans and objectives for future operations,

assumptions underlying such plans and objectives, statements regarding benefits of the

proposed

merger and other forward-looking terminology such as "may," "expects," "believes,"

"anticipates," "intends," "expects," "projects" or similar terms, variations of such terms or the

negative of such terms. There are a number of risks and uncertainties

that could cause actual

results to differ materially from the forward-looking statements made herein. These risks, as

well as other risks associated with the merger, will be more fully discussed in any joint proxy

statement or prospectus or other

relevant document filed with the Securities and Exchange

Commission in connection with the proposed merger. Such information is based upon various

assumptions made by, and expectations of, our management that were reasonable when

made but may prove

to be incorrect. All of such assumptions are inherently subject to

significant economic and competitive uncertainties and contingencies beyond our control

and upon assumptions with respect to the future business decisions which are subject to

change.

Accordingly, there can be no assurance that actual results will meet expectations

and actual results may vary (perhaps materially) from certain of the results ant

icipated herein.

3

Investment Highlights

Resurgence of global interest in nuclear power; several

underserved market segments

Thorium is a superior fuel source utilized in the companys

unique technology

Proven technology with clear path to commercialization

Compelling licensing/partnering strategy with strong intellectual

property protections in place

Revenue from consulting and strategic advisory services

Strong management, directors, technical and international

advisory boards

4

About Thorium Power

Thorium Power is the leading developer of thorium-based

proliferation resistant nuclear fuel technology and provider of

comprehensive advisory services to governments and

commercial entities

Technology consists of fuel designs addressing the key

concerns in the nuclear power industry, including nuclear

proliferation and waste

Technology supports expansion of addressable market and

improved economics for the global nuclear energy industry

Fuel designs are reactor-agnostic, designed and optimized

to be compatible with majority of existing and future reactors

5

Nuclear Renaissance

Desire to reduce dependence on oil and other fossil fuels

Mandates to lower CO2 emissions

Economic and commercial advantages of nuclear power:

Immaturity and cost of renewable/alternative energy

Strong operating performance of nuclear power plants

Nuclear renaissance will include many new nuclear industry

countries

E.g., emerging markets with strong economic growth requiring significant

build-out of electricity generating capacity

Nuclear energy plans announced recently in several new nuclear

countries

Industry will need to address remaining nuclear energy concerns and

challenges going forward

Proliferation, waste, fuel supply/price

Reactor safety largely addressed by new reactor designs and solid

operating record

6

Addressable Markets

Thorium Powers target markets include several hundred light

water nuclear reactors operating worldwide and over a

hundred more reactors that could be built over the next 20-30

years

Target markets include:

Markets with political challenges related to conventional uranium-

based nuclear technology due to proliferation concerns

Markets with logistics challenges and/or negative public opinions

and due to waste concerns

Markets with large thorium deposits

Markets looking to improve operating economics by reducing fuel

cost

7

What is Thorium?

Naturally-occurring, slightly radioactive metal - #90 in periodic

table of Elements

Estimated to be over three times more abundant in the Earths

crust than all forms of uranium combined

Large deposits in the US, India, Australia, Norway and many other

countries

Thorium-based nuclear power produces

less than half the volume of radioactive

waste

Significantly lower long-term radio-toxicity

The energy in one kilogram of thorium

equals four thousand tons of coal

Monazite, a rare-earth-and-thorium

phosphate mineral, is the primary source

of the world's thorium

8

Founded by Industry Leader

Thorium Power was founded by Dr. Alvin Radkowsky

First Chief Scientist U.S. Naval Nuclear Program

Team leader of first commercial nuclear power plant in the U.S.

Designer of more nuclear reactors and fuels than anyone in history

Thorium Power formed in 1992 to develop

nuclear fuels that would sever the link

between nuclear weapons and nuclear

power

A single nuclear reactor running on uranium

produces enough plutonium to produce 25

nuclear bombs per year

Thorium Power seed and blanket fuel

assembly model

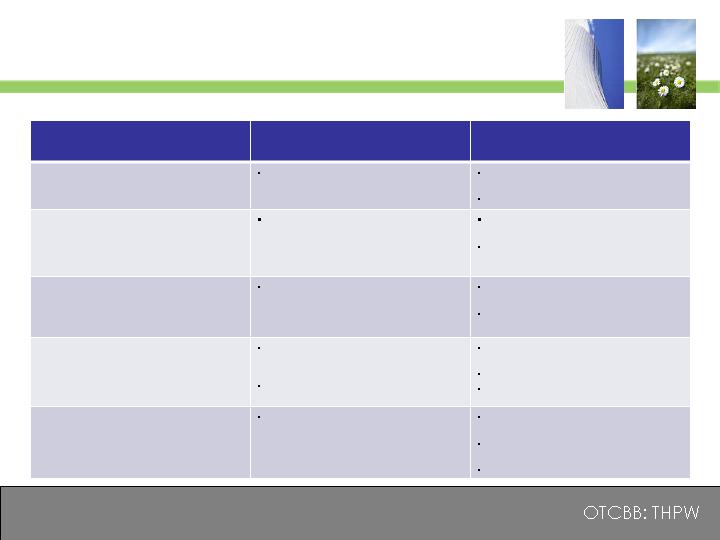

Thorium Power Advantage

Traditional Uranium Fuel

Thorium Power Fuel

Proliferation potential

Reactor produces nuclear weapons-

usable plutonium

No weapons usable materials

produced

Reduction of political risk

Waste volume and

storage time

Produces significant quantities of

radioactive waste which must be

buried for thousands of years

Dramatic waste reduction: - 70%

weight; - 50% volume

90% reduction of waste radio-toxicity

Reactor operating cost

State-of-the-art nuclear reactors cost

$4 billion to build, $50 million per year

to maintain

10-20+% fuel cycle saving vs

conventional fuel

Material impact on profitability and

ROI

Supply flexibility

Uranium ore supply has been steadily

declining worldwide for the past 50

years

Processing costs increasing as reserve

quality declines

Ability to utilize domestic thorium

reserves

Mitigates fuel price volatility

Reduces uranium supply risk

Implementation

Current Uranium fuel provided by fuel

fabricators for existing reactors

Technology licensed to current fuel

fabricators

Utilizes existing light water reactor

designs

Basic industry structure unchanged

9

10

Proven Technology

Engineering & development phase:

Technology has undergone extensive scientific development and

evaluation

Already in research reactor use for over 5 years

Reviewed and favorably evaluated by Westinghouse and IAEA

Technology scale-up and testing phase:

Off-shore development model in place since 90-s including

leading Russian industry experts and facilities

Company now focused on further demonstration and

commercialization of the technology

Technology development and qualification follows

the standard industry process

11

Third-Party Validation

It is Westinghouses opinion that proceeding to the LTA stage is prudent. From the review that we have performed to

date, it appears the [Thorium Power] technology is well founded and has

a good prospect for success based on our

previous US experience and Russian experience with metal fuels.

Westinghouse report commissioned by National Nuclear Security Agency, April 2005

The American Nuclear Society endorses continued research and development of the use of thorium as a fertile fuel

material for nuclear reactors

Waste produced during reactor operations benefits from

the fact that the thorium-uranium

fuel cycle does not readily produce long-lived transuranic elements.

Position Statement from the American Nuclear Society, November 2006

Thorium fuel cycle is an attractive way to produce long term nuclear energy with low radiotoxicity waste. In addition,

the transition to thorium could be done through the incineration of weapons

grade plutonium (WPu) or civilian

plutonium.

Thorium Fuel Cycle Potential Benefits and Challenges, Published by the International Atomic Energy Agency (IAEA) in

2005, TECDOC Series No. 1450

Kazimi said his own experiments show the Radkowsky design to be feasible and support its central claim that it reduces

the amount of plutonium generated in the reactor.

As stated in the May 31, 2008 Financial Times of London. Mujid Kazimi is the director of MIT's Center for Advanced Nuclear

Energy Systems

12

Multi-Pronged Business Model

Thorium Power is currently managing a portfolio of market and partner

leads, limiting the risk of individual projects

Short term:

Advisory and strategic consulting services to foreign governments and

nuclear power companies

Participation in government programs for non-proliferation and waste

management

Medium term:

Participation in thorium-based nuclear energy development consortia

Recurring licensing fees for thorium-based nuclear fuel

Advisory Services Revenue

In December 2007, Thorium Power signed its first major

consulting and strategic advisory services agreement with the

United Arab Emirates (UAE)

Awarded $5 million contract representing the first phase of a

feasibility study to develop a roadmap for the UAEs new

nuclear energy

program

Thorium Power was selected after a detailed technical review

of the companys fuel designs by independent nuclear

experts

Follow on advisory agreement with UAE signed in March 2008

for $4.2 million

Validates Thorium Powers business model, where consulting

services are early revenue drivers leading towards broad

deployment of the companys nuclear fuel designs

13

14

Licensing Strategy

Strong intellectual property protections in place core

technology protected by international patents

Recurring licensing fees with low-cost, highly leverageable

business model

Thorium Power plans to license its technologies to current fuel

fabricators targeting existing and future plant operator

customers

Existing and new reactors in countries with an established nuclear

industry

New reactors in countries without a nuclear industry today

Licensing Model

Average annual nuclear reactor fuel cost $50 million per year

Potential 10-20% fuel cost savings

Additional cost savings of Thorium Fuel:

More efficient process longer fuel life

Lower waste treatment costs

Royalty Model:

High upfront licensing fee, plus recurring royalty streams for use of the

technology

Thorium Power could capture royalties as a meaningful percentage

of the cost savings to the customer

Thorium could capture a percentage of the overall economic value

of the reactor for facilitating nuclear power in non-nuclear countries

15

Near-Term Goals

2008-2009

Further Strengthening of

Corporate Capabilities

2008-2011

Closing of Business Agreements

With Future Reactor Operators and

Industry Partners

2009-2012

Completion of Technology

Milestones Towards Lead Test

Assembly in Commercial Reactors

Additional strategic and

financial relationships

Thorium-focused U.S. legislation,

and government support

benefiting the company

Expansion of intellectual

property & global patent

protection

Scale up the fuel fabrication

process to full length rods used in

commercial reactors

Validate thermal hydraulic

performance of full size seed

and blanket fuel assembly

Complete ampoule irradiation

testing and perform post-

irradiation examination to

confirm fuel performance

Obtain final regulatory approvals

for insertion of fuel in commercial

reactors

Commercial arrangements with:

Future operators of thorium

based reactors

Fuel fabricators

Future participants in

consortia for new reactors

Seek additional revenue from

advisory and pre-construction

services to governments and

commercial entities

16

First Quarter Financial Results

17

(unaudited)

Total Revenue

$

3,815,125

$

-

Cost of Consulting Services Provided

1,648,004

-

Gross Margin

2,167,121

-

Operating Expenses

General and administrative

1,519,046

1,525,779

Research and development expenses

130,661

28,683

Stock-based compensation

1,363,803

1,335,517

Total Operating Expenses

3,013,510

2,889,979

Operating loss

(846,389

)

(2,889,979

)

Total Other Income and Expenses

89,282

112,586

Net loss

(787,935

)

(2,777,393

)

Net Loss Per Common Share, Basic and diluted

$

(.00

)

$

(.01

)

Weighted Average Number of shares outstanding for the

period used to compute per share data

299,064,014

295,165,399

Three Months Ended March 31,

2008

2007

18

Balance Sheet Highlights

As of March 31, 2008

Cash and cash equivalents

$

4,705,577

Total Current Assets

$

6,986,389

Total Assets

$

7,233,978

Total Current Liabilities

$

3,138,983

Total Liabilities

$

3,138,983

Total Stockholders' Equity

$

4,094,995

Total Liabilities and Shareholders Equity

$

10,733,957

Clean capital structure and no long-term debt

19

Experienced Mgmt & Board

Senior Management

Seth Grae - President, Chief Executive Officer, and Member of the Board of Directors

Erik Hällström - Chief Operating Officer

James D. Guerra Chief Financial Officer and Treasurer

Andrey Mushakov - Executive Vice President - International Nuclear Operations

Ambassador Dennis K. Hays - VP Government Relations, Corporate Secretary

Peter Charles - Director of Corporate Affairs and Investor Relations

Maria Mastroianni VP of Human Resource

Board of Directors

Ambassador Thomas Graham, Jr. - Chairman of the Board

Seth Grae President & CEO

Victor Alessi

Daniel Barstow Magraw, Jr.

Jack D. Ladd

20

Investment Highlights

Resurgence of global interest in nuclear power; several

underserved market segments

Thorium is a superior fuel source utilized in the companys

unique technology

Proven technology with clear path to commercialization

Compelling licensing/partnering strategy with strong intellectual

property protections in place

Revenue from consulting and strategic advisory services

Strong management, directors, technical and international

advisory boards