424B5: Prospectus [Rule 424(b)(5)]

Published on July 23, 2010

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated November 24, 2009)

Filed

pursuant to Rule 424(b)(5)

No.

333-162671

2,069,992 Shares of Common Stock

Warrants

to Purchase up to 1,034,996 Shares of Common Stock

Lightbridge

Corporation

This

prospectus supplement and the accompanying prospectus relate to the offering of

2,069,992 shares of our common stock, par value $0.001 per share, and warrants

to purchase up to 1,034,996 shares of common stock at an exercise price of $9.00

per share. The securities will be sold in multiples of a fixed

combination consisting of one share of common stock and a warrant to purchase

0.5 shares of common stock, at an initial exercise price of

$9.00. Each fixed combination will be sold at a price of $6.60 per

fixed combination. The warrants will be exercisable on or after the

date that is six months and one day after the date the warrants are issued and

will expire on the seventh anniversary of the date the warrants are

issued. In this prospectus supplement, we refer to the shares and

warrants collectively as the “securities.” The shares of common stock and

warrants will be issued separately.

Our

common stock is listed on the NASDAQ Capital Market under the symbol “LTBR.” On

July 22, 2010, the last reported per share sale price of our common stock was

$7.65. We do not intend to apply for listing of the warrants on any

national securities exchange or for inclusion of the warrants in any automated

quotation system.

We have

retained William Blair & Company to act as our exclusive placement agent in

connection with this offering. See “Plan of Distribution” beginning on page S-14

of this prospectus supplement for more information regarding these

arrangements. You should carefully consider the risk factors

beginning on page S-9 of this prospectus supplement and set forth in the

documents incorporated by reference herein before making any decision to invest

in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus or

any prospectus supplement is truthful or complete. Any representation to the

contrary is a criminal offense.

|

Per

Fixed Combination

|

Total

|

|

|

Public

offering price

|

$6.60

|

$13,661,947.20

|

|

Placement

agent fee

|

$0.396

|

$819,716.83

|

|

Proceeds,

before expenses, to us

|

$6.204

|

$12,842,230.37

|

______________________________________

William

Blair & Company, L.L.C. is acting as the exclusive placement agent in

connection with this offering. The placement agent is not purchasing

or selling any of the securities pursuant to this prospectus supplement or the

accompanying prospectus. We estimate the total expenses of this offering,

excluding the placement agent fee, will be approximately $125,000. Because there

is no minimum offering amount required as a condition to closing in this

offering, the actual public offering amount, placement agent fee and net

proceeds to us, if any, in this offering are not presently determinable and may

be substantially less than the total maximum offering amounts set forth

above. We are not required to sell any specific number or dollar

amount of the securities offered in this offering, but the placement agent will

use its best efforts to sell the securities offered. It is

anticipated that the shares of common stock and the warrants will be delivered

against payment thereon on or before July 28, 2010.

______________________________________

William

Blair & Company

The date

of this prospectus supplement is July 22, 2010

TABLE

OF CONTENTS

Prospectus

Supplement

|

Page

|

|

|

About

This Prospectus Supplement

|

S-1

|

|

Forward-Looking

Statements

|

S-1

|

|

Prospectus

Summary

|

S-3

|

|

The

Offering

|

S-8

|

|

Risk

Factors

|

S-9

|

|

Use

Of Proceeds

|

S-10

|

|

Price

Range Of Common Stock

|

S-11

|

|

Dividend

Policy

|

S-11

|

|

Capitalization

|

S-11

|

|

Description

Of Securities We Are Offering

|

S-12

|

|

Plan

Of Distribution

|

S-13

|

|

Legal

Matters

|

S-16

|

|

Experts

|

S-16

|

|

Incorporation

Of Certain Information By Reference

|

S-16

|

|

Prospectus

|

|

|

About

This Prospectus

|

1

|

|

Use

Of Terms

|

1

|

|

Lightbridge

Corporation

|

1

|

|

Risk

Factors

|

3

|

|

Forward-Looking

Statements

|

3

|

|

Use

Of Proceeds

|

4

|

|

Ratios

Of Earnings To Fixed Charges

|

4

|

|

Description

Of Capital Stock

|

5

|

|

Description

Of Warrants

|

7

|

|

Description

Of Debt Securities

|

9

|

|

Description

Of Units

|

18

|

|

Plan

Of Distribution

|

19

|

|

Legal

Matters

|

20

|

|

Experts

|

21

|

|

Where

You Can Find Additional Information

|

21

|

|

Incorporation

Of Certain Information By Reference

|

21

|

This

prospectus supplement and the accompanying prospectus, dated November 24, 2009,

are part of a registration statement on Form S-3 (File No. 333-162671) that

we filed with the Securities and Exchange Commission using a “shelf”

registration process. Under this “shelf” registration process, we may from time

to time sell any combination of securities described in the accompanying

prospectus in one or more offerings. In this prospectus supplement,

we provide you with specific information about the terms of this

offering.

As permitted under the rules of the

SEC, this prospectus incorporates by reference important information about us

that is contained in documents that we file with the SEC, but that are not

attached to or delivered with this prospectus. You may obtain copies of these

documents, without charge, from the website maintained by the SEC at

www.sec.gov, as well as other sources. See “Incorporation of Certain Information

by Reference” for further information.

S-1

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document comprises two parts. The first part is this prospectus supplement,

which describes the specific terms of this offering of common stock and warrants

and also adds to and updates information contained in the accompanying

prospectus and the documents incorporated by reference into the prospectus. The

second part, the accompanying prospectus, gives more general information, some

of which may not apply to this offering. If the description of the offering or

the specific terms of the securities offered varies between this prospectus

supplement and the accompanying prospectus, you should rely on the information

contained in this prospectus supplement. However, if any statement in one of

these documents is inconsistent with a statement in another document having a

later date — for example, a document incorporated by reference in the

accompanying prospectus — the statement in the document having the later

date modifies or supersedes the earlier statement.

You

should rely only on the information contained in or incorporated by reference

into this prospectus supplement and the accompanying prospectus to which it

relates and any free writing prospectus that we may authorize to be provided to

you. No dealer, salesperson or other person is authorized to give any

information or to represent anything not contained in this prospectus. You must

not rely on any unauthorized information or representations. The information

contained in this prospectus supplement and contained, or incorporated by

reference, in the accompanying prospectus is accurate only as of the respective

dates thereof, regardless of the time of delivery of this prospectus supplement

and the accompanying prospectus or of any sale of securities hereunder. This

prospectus is an offer to sell only the shares and warrants offered hereby, but

only under circumstances and in jurisdictions where it is lawful to do

so.

FORWARD-LOOKING

STATEMENTS

This

prospectus supplement, the accompanying prospectus, any applicable free writing

prospectus, and the documents that we have filed with the SEC that are included

or incorporated by reference in this prospectus supplement and the accompanying

prospectus contain “forward-looking statements” within the meaning of such term

in Section 27A of the Securities Act of 1933, as amended, or the Securities Act,

and Section 21E of the Securities Exchange Act of 1934, as amended, or the

Exchange Act. In addition, other written or oral statements that

constitute forward-looking statements are based on current expectations,

estimates and projections about the industry and markets in which we operate and

statements may be made by or on our behalf. Words such as “should,” “could,”

“may,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,”

variations of such words and similar expressions are intended to identify such

forward-looking statements. These statements are not guarantees of future

performance and involve certain risks, uncertainties and assumptions that are

difficult to predict. There are a number of important factors that could cause

our actual results to differ materially from those indicated by such

forward-looking statements.

We

describe material risks, uncertainties and assumptions that could affect our

business, including our financial condition and results of operations, under

“Risk Factors” in this prospectus supplement and the accompanying prospectus and

may update our descriptions of such risks, uncertainties and assumptions in any

prospectus supplement or in any report incorporated by reference in this

prospectus supplement and the accompanying prospectus. We base our

forward-looking statements on our management’s beliefs and assumptions based on

information available to our management at the time the statements are made. We

caution you that actual outcomes and results may differ materially from what is

expressed, implied or forecast by our forward-looking statements. Accordingly,

you should be careful about relying on any forward-looking statements. Reference

is made in particular to forward-looking statements regarding growth strategies,

financial results, product and service development, competitive strengths,

intellectual property rights, future market acceptance of our products,

financing activities, ongoing contractual obligations and business development

and marketing and sales efforts. Except as required under the federal securities

laws and the rules and regulations of the SEC, we do not have any intention or

obligation to update publicly any forward-looking statements after the

distribution of this prospectus, whether as a result of new information, future

events, changes in assumptions, or otherwise.

Additional

disclosures regarding factors that could cause our results and performance to

differ from historical or anticipated results or performance are discussed in

this prospectus supplement, the accompanying prospectus, any applicable free

writing prospectus, or in the reports incorporated by reference into this

prospectus supplement and accompanying prospectus. You are urged to carefully

review and consider the various disclosures made by us in those documents before

making any investment decision. The forward-looking statements speak only as of

the date made and we disclaim any obligation to provide updates, revisions or

amendments to any forward-looking statements to reflect changes in our

expectations or future events.

S-2

PROSPECTUS

SUMMARY

This

summary highlights information about us and the offering contained elsewhere in,

or incorporated by reference into, this prospectus supplement and the

accompanying prospectus. It is not complete and may not contain all the

information that may be important to you. You should carefully read the entire

prospectus supplement, the accompanying prospectus, any applicable free writing

prospectus, as well as the information incorporated by reference, before making

an investment decision, especially the information presented under the heading

“Risk Factors” beginning on page S-9 of this prospectus supplement,

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in our most recent Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q for the quarterly period ended June 30, 2010, and our consolidated

financial statements which are incorporated by reference.

Overview

We are a

developer of next generation nuclear fuel technology that will significantly

up-rate the power output of reactors, reducing the per-megawatt-hour cost of

generating nuclear energy and reduce nuclear waste and

proliferation. We are also a provider of nuclear energy consulting

services to commercial and governmental entities worldwide.

Technology

Business Segment

For most

of the past decade we have been engaged in the development of proprietary

nuclear fuel designs which we ultimately intend to introduce for use in nuclear

power plants around the world in partnership with one or more major nuclear fuel

vendors. Our proprietary nuclear fuel designs are primarily

geared toward two target markets: (1) nuclear fuel designs for use in commercial

nuclear power plants and (2) nuclear fuel designs for reactor-grade plutonium

disposition. In addition, we have a conceptual nuclear fuel design

for weapons-grade plutonium disposition. We have been conducting research and

development related to two variants of these nuclear fuel designs: (1) A fuel

variant for use in Russian-designed VVER-1000 reactors, and (2) A fuel variant

for use in Western-type pressurized water reactors (PWRs).

As an

outgrowth of this research and development, we have recently designed a new

commercial fuel technology based on a proprietary all-metal fuel assembly

configuration that has the potential to increase power output per reactor

compared to reactors operating on conventional uranium oxide

fuel. The new fuel design could reduce both initial capital costs per

megawatt and annual operating costs per kilowatt-hour of nuclear power, making

it more competitive with other forms of electricity generation while

contributing to a significant reduction of CO2 emissions.

It is

expected that our all-metal fuel technology could be applied to currently

operating or new light water reactors as well as small modular reactors while

providing the same benefits as in larger commercial nuclear power

plants. It is also highly synergistic with fast reactor designs under

development around the world.

In June

2010, Idaho National Laboratory has approved a Texas A&M University-led

joint proposal with us for irradiation testing of this kind of metallic fuel in

the Advanced Test Reactor. The fuel demonstration in a test reactor

environment is a key milestone to demonstration and deployment of this fuel in

commercial Western-type light water reactors. Testing is expected to

begin in 2011.

Our

future customers may include nuclear fuel fabricators, nuclear power plants

and/or the U.S. or international governments.

Our

operations within our technology business segment have been devoted primarily to

the development and demonstration of our nuclear fuel designs, developing

strategic relationships within and outside of the nuclear power industry,

securing political and financial support from the U.S. and Russian governments,

and the filing of patent applications (including related administrative

functions).

S-3

Currently,

we have generated only minimal direct revenues from our technology business

segment, and we do not expect that we will generate licensing revenues from this

business for several years, until our fuel designs can be fully tested and

demonstrated and we obtain the proper approvals to use our nuclear fuel designs

in nuclear reactors. We believe we can leverage our general nuclear technology,

business and regulatory expertise as well as industry relationships, to optimize

our technology development plans and create integrated advisory services with

the highest levels of expertise and experience in the nuclear power

industry.

Consulting

and Strategic Advisory Services Business Segment

We are

primarily engaged in the business of assisting commercial and governmental

entities with developing and expanding their nuclear industry capabilities and

infrastructure. We provide integrated strategic advice across a range of

expertise areas including, for example, nuclear reactor procurement and

deployment, reactor and fuel technology, international relations and regulatory

affairs.

Due to

the relatively limited growth in the nuclear energy industry during the 1980’s

and 1990’s, and corresponding limited recruitment into the industry, the cadre

of engineers, managers and other nuclear energy industry experts is aging. In

any nuclear renaissance, we believe that the industry will be challenged in

acquiring and retaining sufficient qualified expertise. Moreover, in countries

studying new nuclear energy programs, the number of qualified nuclear energy

personnel is very limited, and we believe that those countries will need to rely

on significant support from non-domestic service providers and experts to ensure

success in those programs.

Our

emergence in the field of nuclear energy consulting is in direct response to the

need for independent assessments and highly qualified technical consulting

services from countries looking to establish nuclear energy programs, by

providing a blueprint for safe, clean, efficient and cost-effective

non-proliferative nuclear power. We offer full-scope strategic planning and

advisory services for new and growing existing markets. Furthermore, we only

engage with commercial entities and governments that are dedicated to

non-proliferative and transparent nuclear programs.

Our

consulting services are expert and relationship based, with particular emphasis

on top-of-mind issues of key decision makers in senior positions within

governments or companies, as well as focus on overall management of nuclear

energy programs. To date, substantially all of our revenues are

derived from our business segment which provides nuclear consulting services to

entities within the United Arab Emirates, our first significant consulting and

strategic advisory client. In April 2010 we began to provide

consulting services in an additional country.

The

address of our principal executive office is 1600 Tysons Boulevard, Suite 550,

McLean, Virginia 22102 and our telephone number is (571) 730-1200. We

maintain a website at www.Ltbridge.com that

contains information about our Company, though no information contained on our

website is part of this prospectus.

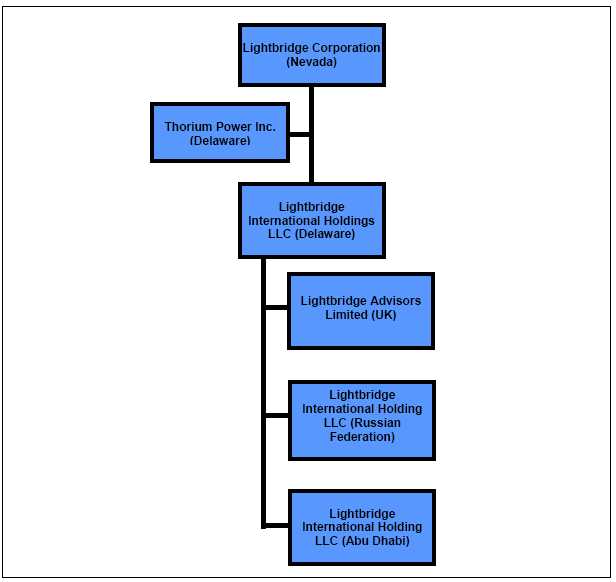

Corporate

Structure

The

following chart reflects our current corporate organizational

structure:

S-4

S-5

Summary

Consolidated Financial Information

The

following tables set forth our summary consolidated financial data as of and for

the years ended December 31, 2009 and 2008, as well as summary consolidated

financial data as of and for the six months ended June 30, 2010 and 2009. The

summary consolidated financial data set forth below has been derived from our

audited consolidated financial statements and related notes thereto where

applicable for the respective fiscal years, which are incorporated by reference

in this prospectus supplement and the related prospectus. The summary

consolidated financial data as of and for the six months ended June 30, 2010 and

2009, were derived from our unaudited condensed consolidated financial

statements and related notes thereto. The summary consolidated financial data

should be read in conjunction with “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” as well as our consolidated

financial statements and notes thereto contained in our Annual Report on Form

10-K for the year ended December 31, 2009 and our Quarterly Report on Form 10-Q

for the six months ended June 30, 2010 which are incorporated by reference

herein. These historical results are not necessarily indicative of the results

to be expected in any subsequent fiscal quarters or for the year ended December

31, 2010.

|

For

the Six Months

|

For

the Years Ended

|

|||||||||||||||

|

Ended

June 30,

|

December

31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

(unaudited)

|

||||||||||||||||

|

Statements

of Income Data

|

||||||||||||||||

|

(in

thousands, except per share data):

|

||||||||||||||||

|

Consulting

revenue

|

$ | 4,361 | $ | 6,374 | $ | 10,516 | $ | 22,220 | ||||||||

|

Cost

of consulting services provided

|

2,768 | 3,637 | 6,228 | 11,089 | ||||||||||||

|

Gross

margin

|

1,593 | 2,737 | 4,288 | 11,131 | ||||||||||||

|

Operating

expenses

|

||||||||||||||||

|

General

and administrative expenses

|

4,916 | 4,605 | 9,896 | 12,608 | ||||||||||||

|

Research

and development expenses

|

363 | 1,013 | 1,632 | 1,565 | ||||||||||||

|

Total

operating expenses

|

5,279 | 5,618 | 11,528 | 14,173 | ||||||||||||

|

Operating

loss

|

(3,686 | ) | (2,881 | ) | (7,240 | ) | (3,042 | ) | ||||||||

|

Other

income and (expenses)

|

||||||||||||||||

|

Interest

income

|

1 | 17 | 22 | 163 | ||||||||||||

|

Other

|

(2 | ) | (5 | ) | 0 | 0 | ||||||||||

|

Realized

loss on marketable securities

|

0 | 0 | (15 | ) | 30 | |||||||||||

|

Total

other income and expenses

|

(1 | ) | 12 | 7 | 193 | |||||||||||

|

Net

loss before income taxes

|

(3,687 | ) | (2,869 | ) | (7,233 | ) | (2,849 | ) | ||||||||

|

Income

taxes

|

0 | 0 | 0 | 0 | ||||||||||||

|

Net

loss

|

(3,687 | ) | (2,869 | ) | (7,233 | ) | (2,859 | ) | ||||||||

|

Net

loss per common share, basic and diluted

|

(0.36 | ) | (0.29 | ) | (0.72 | ) | (0.29 | ) | ||||||||

|

Weighted

average number of shares outstanding for the period used to compute per

share data - (prior reporting periods restated to reflect 1 for 30 reverse

stock split)

|

$ | 10,232,553 | $ | 10,055,580 | $ | 10,021,429 | $ | 10,002,364 | ||||||||

|

Statements

of Cash Flow Data (in thousands):

|

||||||||||||||||

|

Net

cash used in operating activities

|

$ | (317 | ) | $ | (639 | ) | $ | (2,561 | ) | $ | (3,615 | ) | ||||

|

Net

cash used in investing activities

|

(23 | ) | (30 | ) | (39 | ) | (102 | ) | ||||||||

|

Net

cash provided by (used in) financing activities

|

389 | 0 | 48 | (610 | ) | |||||||||||

S-6

|

As

of

June

30,

|

As

of

December

31,

2010

|

|||||||||||

|

2010

|

2009

|

2008

|

||||||||||

|

Balance

Sheet Data (in thousands):

|

||||||||||||

|

Cash

and cash equivalents

|

$ | 3,077 | $ | 3,029 | $ | 5,580 | ||||||

|

Restricted

cash

|

264 | 652 | 650 | |||||||||

|

Accounts

receivable - project revenue and reimbursable project

costs

|

1,133 | 2,421 | 5,358 | |||||||||

|

Prepaid

expenses & other current assets

|

389 | 574 | 394 | |||||||||

|

Total

current assets

|

4,863 | 6,676 | 11,982 | |||||||||

|

Property

plant and equipment – net

|

84 | 98 | 108 | |||||||||

|

Total

other assets

|

385 | 362 | 357 | |||||||||

|

Total

assets

|

5,332 | 7,136 | 12,447 | |||||||||

|

Total

liabilities

|

1,760 | 2,162 | 5,139 | |||||||||

|

Total

stockholders’ equity

|

3,572 | 4,974 | 7,308 | |||||||||

|

Total

liabilities and stockholders’ equity

|

$ | 5,332 | $ | 7,136 | $ | 12,447 | ||||||

S-7

THE

OFFERING

|

Common

stock offered by us

|

2,069,992

shares

|

|

Warrants

offered by us

|

Warrants

to purchase up to 1,034,996 shares of common stock, exercisable at $9.00

per share following the sixth (6th)

month anniversary of this offering. The warrants will expire seven

(7) years after the date of issuance of the

warrants.

|

|

Common

stock to be outstanding after

this offering

|

12,419,967

shares (not including warrant shares) (1)

|

|

Use

of proceeds

|

We

will use the net proceeds we receive from the sale of the shares of common

stock and warrants offered hereby for research and development of our

nuclear fuel designs and general working capital purposes. See

“Use of Proceeds.”

|

|

Lock-Up

Agreements

|

We

and each of our directors and executive officers have agreed, subject to

certain exceptions, not to sell, transfer or dispose of any shares of our

common stock for a period of 60 days from the date of this prospectus

supplement. See “Plan of Distribution.”

|

|

NASDAQ

Capital Market Symbol

|

LTBR

|

|

(1)

|

Based

on 10,349,975 shares of common stock outstanding prior to the closing

of this offering as of July 22, 2010 and excludes any (1) unexercised

options and warrants, (2) convertible securities that have not yet been

converted, and (3) other securities of the Company that are exercisable or

exchangeable for, or convertible into, common stock of the Company that

have not yet been so exercised, exchanged or

converted.

|

S-8

RISK

FACTORS

Before

you invest in our common stock, you should carefully consider the risk factors

specified below, those risk factors set forth in the accompanying prospectus,

our annual report on Form 10-K for the year ended December 31, 2009 and our

quarterly reports on Form 10-Q for the quarters ended March 31, 2010 and June

30, 2010, together with all of the other information and documents included or

incorporated by reference in this prospectus supplement, the accompanying

prospectus, and the documents incorporated by reference herein or therein, in

evaluating an investment in our common stock. If any of the risks discussed

below, in the accompanying prospectus, our annual report on Form 10-K for the

year ended December 31, 2009 and our quarterly reports on Form 10-Q for the

quarters ended March 31, 2010 and June 30, 2010, or in any document incorporated

by reference into this prospectus supplement or the accompanying prospectus,

were actually to occur, our business, financial condition, results of

operations, or cash flow could be materially adversely affected. In that case,

the trading price of our common stock could decline and you could lose all or

part of your investment

Management

will have broad discretion as to the use of the proceeds from this offering, and

we may not use the proceeds effectively.

We have

not designated the amount of net proceeds from this offering to be used for any

particular purpose. Accordingly, our management will have broad discretion as to

the application of the net proceeds from this offering and could use them for

purposes other than those contemplated at the time of this offering. Our

shareholders may not agree with the manner in which our management chooses to

allocate and spend the net proceeds. Moreover, our management may use the net

proceeds for corporate purposes that may not increase our profitability or

market value.

You

will experience immediate dilution in the book value per share of the common

stock you purchase.

Because

the price per share of our common stock being offered is substantially higher

than the book value per share of our common stock, you will suffer substantial

dilution in the net tangible book value of the common stock you purchase in this

offering. Based on the public offering price of $6.60 per share and the net

tangible book value of the common stock of $0.32 per share as of June 30, 2010,

if you purchase shares of common stock in this offering, you will suffer

dilution of $5.32 per share in the net tangible book value of the common

stock. Purchasers in this offering will suffer additional dilution in

the event they exercise the warrants offered hereby.

A

large number of shares may be sold in the market following this offering, which

may depress the market price of our common stock.

All of

the shares of our common stock sold in the offering, including shares issuable

upon exercise of the warrants, will be freely tradable without restriction or

further registration under the Securities Act. As a result, a substantial number

of shares of our common stock may be sold in the public market following this

offering, which may cause the market price of our common stock to decline. If

there are more shares of common stock offered for sale than buyers are willing

to purchase, then the market price of our common stock may decline to a market

price at which buyers are willing to purchase the offered shares of common stock

and sellers remain willing to sell the shares.

There

is no public market for the warrants to purchase common stock in this

offering.

There is

no established public trading market for the warrants being offered in this

offering, and we do not expect a market to develop. In addition, we do not

intend to apply to list the warrants on any securities exchange. Without an

active market, the liquidity of the warrants will be limited.

S-9

USE

OF PROCEEDS

We

estimate that the net proceeds from the sale of the securities we are offering

will be approximately $12.7 million, assuming that we sell all of the securities

we are offering, after deducting the placement agent’s fees and estimated

offering expenses payable by us. This amount does not include the

proceeds that we may receive in connection with any exercise of the warrants

issued in this offering.

We

will use the majority of the net proceeds we receive from the sale of the shares

of common stock and warrants offered by this prospectus supplement and the

accompanying prospectus for research and development of our nuclear fuel designs

and general working capital purposes.

Although

we have identified some potential uses of the net proceeds to be received upon

completion of this offering, we cannot specify these uses with

certainty. Our management will have broad discretion in the

application of the net proceeds from this offering and could use them for

purposes other than those contemplated at the time of this

offering. Our stockholders may not agree with the manner in which our

management chooses to allocated and spend the net proceeds. Moreover,

our management may use the net proceeds for corporate purposes that may not

result in our being profitable or increase our market value.

Until we

use the net proceeds of this offering, we intend to invest the funds in

short-term, investment grade, interest-bearing securities.

DILUTION

Purchasers

of shares of our common stock in this offering will suffer an immediate and

substantial dilution in net tangible book value per share. Net

tangible book value per share is total tangible assets, reduced by total

liabilities, divided by the total number of outstanding shares of common

stock. Our net tangible book value as of June 30, 2010 was

approximately $3.3 million, or approximately $0.32 per outstanding share of

common stock.

After

giving effect to the sale of the securities and the application of the net

proceeds therefrom at a public offering price of $6.60 per fixed combination of

securities (and excluding shares of common stock issued and any proceeds

received upon exercise of the warrants), our adjusted net tangible book value as

of June 30, 2010 would have been approximately $15.8 million, or approximately

$1.28 per share. This represents an immediate increase in net

tangible book value of $0.96 per share to our existing stockholders and an

immediate dilution of $5.32 per share to new investors. The following

table illustrates this calculation on a per share basis, assuming that we sell

all of the securities we are offering:

|

Public

offering price per fixed combination

|

$

|

6.60

|

||

|

Net

tangible book value per share as of June 30, 2010

|

$

|

0.32

|

||

|

Increase

in net tangible book value per share attributable to new

investors

|

$

|

0.96

|

||

|

Adjusted

net tangible book value per share as of June 30, 2010 after giving effect

to this offering

|

$

|

1.28

|

||

|

Dilution

per share to new investors

|

$

|

5.32

|

Investors that acquire additional

shares of common stock through the exercise of the warrants offered hereby may

experience additional dilution depending on our net tangible book value at the

time of exercise.

The amounts above are based

on 10,307,513 shares of common stock

outstanding as of June 30, 2010, and assume no exercise of

outstanding options or warrants since that date. The number of shares

of common stock anticipated to be outstanding after this offering

excludes:

|

|

·

|

1,899,691 shares of our common

stock issuable upon the exercise of outstanding stock options under our

2006 Stock Plan, having a

weighted average exercise price of $13.03 per share;

and

|

|

|

·

|

1,034,996 shares

of common stock issuable upon the exercise of warrants to be issued in

this offering.

|

S-10

To the

extent that any of our outstanding options or warrants are exercised, we grant

additional options under our stock option plans or issue additional warrants, or

we issue additional shares of common stock in the future, there may be further

dilution to new investors.

PRICE

RANGE OF COMMON STOCK

Our

common stock is traded on the Nasdaq Capital Market under the symbol

“LTBR.”

The

following table sets forth, for the periods indicated, the high and low reported

sales prices of our common stock.

|

Sales Prices(1)

|

||||||||

|

High

|

Low

|

|||||||

|

Year

ended December 31, 2010

|

||||||||

|

Third

Quarter (through July 22,

2010)

|

$ |

8.68

|

$ | 6.78 | ||||

|

Second

Quarter

|

11.15 | 5.26 | ||||||

|

First

Quarter

|

9.00 | 5.99 | ||||||

|

Year

ended December 31, 2009

|

||||||||

|

Fourth

Quarter

|

$ | 13.00 | $ | 5.01 | ||||

|

Third

Quarter

|

11.40 | 5.40 | ||||||

|

Second

Quarter

|

7.50 | 5.10 | ||||||

|

First

Quarter

|

9.60 | 3.90 | ||||||

|

Year

ended December 31, 2008

|

||||||||

|

Fourth

Quarter

|

$ | 7.50 | $ | 3.90 | ||||

|

Third

Quarter

|

8.67 | 4.20 | ||||||

|

Second

Quarter

|

10.05 | 6.30 | ||||||

|

First

Quarter

|

11.55 | 6.33 | ||||||

________________________

|

(1)

|

The

last reported sales price of our common stock on the Nasdaq Capital Market

on July 22, 2010 was $7.65. As of July 22, 2010, there were

approximately 209

stockholders of record of our common stock. Certain of our shares are held

in “nominee” or “street” name; accordingly, we believe the number of

beneficial owners is greater than the foregoing

number.

|

DIVIDEND

POLICY

We have

never declared or paid cash dividends. Any future decisions regarding dividends

will be made by our Board of Directors. We currently intend to retain and use

any future earnings for the development and expansion of our business and do not

anticipate paying any cash dividends in the foreseeable future.

Our Board

of Directors has complete discretion on whether to pay dividends, subject to the

approval of our shareholders. Even if our Board of Directors decides to pay

dividends, the form, frequency and amount will depend upon our future operations

and earnings, capital requirements and surplus, general financial condition,

contractual restrictions and other factors that the Board of Directors may deem

relevant.

CAPITALIZATION

The

following table sets forth our cash and cash equivalents and capitalization as

of June 30, 2010, both on an actual basis and as adjusted to give effect to the

sale of 2,069,992 shares of common stock by us in this offering at a public

offering price of $6.60 per share, after deducting estimated placement agent

fees and estimated offering expenses payable by us assuming no exercise of the

warrants.

S-11

This

table should be read in conjunction with “Use of Proceeds” and our unaudited

consolidated financial statements, including the related notes, included or

incorporated by reference in this prospectus supplement.

|

As of June

30, 2010

|

||||||||

|

Actual

|

As Adjusted

|

|||||||

|

(dollars

in thousands, except

per

share data)

|

||||||||

|

Cash

and cash equivalents

|

$ | 3,077 | 15,612 | |||||

|

Current

Liabilities

|

||||||||

|

Accounts

payable and accrued liabilities

|

1,760 | 1,760 | ||||||

|

Total

Current Liabilities

|

1,760 | 1,760 | ||||||

|

Stockholder’s

Equity

|

3,572 | 16,084 | ||||||

|

Preferred

stock, $0.001 par value; 50,000,000 authorized shares, no shares issued

and outstanding

|

0 | 0 | ||||||

|

Common

stock, $0.001 par value; 500,000,000 authorized, shares issued and

outstanding at June 30 2010: 10,307,513 shares,

actual, 12,377,505, as adjusted for this offering

|

10 | 12 | ||||||

|

Additional

paid-in capital - stock and stock equivalents

|

56,539 | 69,049 | ||||||

|

Accumulated

Deficit

|

(52,411 | ) | (52,411 | ) | ||||

|

Common

stock reserved for issuance, 4,204 shares at June 30,

2010

|

35 | 35 | ||||||

|

Deferred

stock compensation

|

(601 | ) | (601 | ) | ||||

|

Total

Stockholders’ Equity

|

3,572 | 16,084 | ||||||

|

Total

Capitalization

|

3,572 | 16,084 | ||||||

In

this offering, we are offering a maximum of up to 2,069,992 shares of our common

stock and warrants to purchase up to an additional 1,034,996 shares of our

common stock. The securities will be sold in multiples of a fixed combination

consisting of one share of common stock and a warrant to purchase 0.5

shares of common stock, at an initial exercise price of $9.00. We are

offering the fixed combination at a negotiated price of $6.60 per fixed

combination.

Common

Stock

The

following description of our common stock is a summary. It is not

complete and is subject to and qualified in its entirety by our Articles of

Incorporation, as amended, and Amended and Restated Bylaws, as amended, a copy

of each of which has been incorporated as an exhibit to the registration

statement of which this prospectus supplement forms a part.

As of the

date of this prospectus supplement, our articles of incorporation authorizes us

to issue 500,000,000 shares of common stock, par value $0.001 per share,

and 50,000,000 shares of preferred stock, par value $0.001 per

share. As of July 22, 2010, 10,349,975 shares of common stock

were outstanding and no shares of preferred stock were outstanding.

The

material terms and provisions of our common stock are described under the

caption “Description of Capital Stock” starting on page 5 of the

accompanying prospectus.

S-12

Warrants

The

material terms and provisions of the warrants being offered pursuant to this

prospectus supplement and the accompanying prospectus are summarized

below. The summary is subject to, and qualified in its entirety by,

the form of warrant which will be provided to each purchaser in this offering

and will be filed as an exhibit to a Current Report on Form 8-K with the SEC in

connection with this offering.

Each

purchaser will receive, for each fixed combination purchased, one share of our

common stock and a warrant representing the right to purchase 0.5 shares of

common stock at an initial exercise price of $9.00 per share of common

stock. The warrants will be exercisable on or after the date that is

six months and one day after the date the warrants are issued and will terminate

on the seventh (7th) anniversary

of the date the warrants are issued. The exercise price and the

number of shares for which each warrant may be exercised is subject to

appropriate adjustment in the event of stock dividends, stock splits,

reorganizations or similar events affecting our common stock and the exercise

price of warrants held by a purchaser (or such purchaser’s direct or indirect

transferee) is subject to appropriate adjustment in the event of cash dividends

or other distributions to holders of shares of our common stock.

There is

no established public trading market for the warrants, and we do not expect a

market to develop. We do not intend to apply to list the warrants on

any securities exchange. Without an active market, the liquidity of

the warrants will be limited. In addition, in the event our common

stock price does not exceed the per share exercise price of the warrants during

the period when the warrants are exercisable, the warrants will not have any

value.

Holders

of the warrants may exercise their warrants to purchase shares of our common

stock by delivering an exercise notice, appropriately completed and duly

signed. Payment of the exercise price for the number of shares for

which the warrant is being exercised is required to be delivered within one

trading day after exercise of the warrant. In the event that the

registration statement relating to the warrant shares is not effective, a holder

of warrants will have the right to exercise its warrants for a net number of

warrant shares pursuant to the cashless exercise procedures specified in the

warrants. Warrants may be exercised in whole or in part, and any

portion of a warrant not exercised prior to the termination date shall be and

become void and of no value. The absence of an effective registration statement

or applicable exemption from registration does not alleviate our obligation to

deliver common stock issuable upon exercise of a warrant. Upon the

holder’s exercise of a warrant, we will issue the shares of common stock

issuable upon exercise of the warrant within three trading days of our receipt

of notice of exercise.

The

shares of common stock issuable on exercise of the warrants will be, when issued

in accordance with the warrants, duly and validly authorized, issued and fully

paid and non-assessable. We will authorize and reserve at least that number of

shares of common stock equal to the number of shares of common stock issuable

upon exercise of all outstanding warrants.

If, at

any time warrants are outstanding, we consummate any fundamental transaction, as

described in the warrants and generally including any consolidation or merger

into another corporation, the consummation of a transaction whereby another

entity acquires more than 50% of our outstanding voting stock, or the sale of

all or substantially all of our assets, the holder of any warrants will

thereafter receive upon exercise of the warrants, the securities or other

consideration to which a holder of the number of shares of common stock then

deliverable upon the exercise of such warrants would have been entitled upon

such consolidation or merger or other transaction. Furthermore, we

cannot enter into a fundamental transaction unless the successor entity assumes

in writing all of our obligations to the warrant

holders. Additionally, in the event of a fundamental transaction,

each warrant holder will have the right to require us, or our successor, to

repurchase its warrant for an amount of cash equal to the Black-Scholes value of

the remaining unexercised portion of the warrant on the date of the consummation

of such fundamental transaction.

The

exercisability of the warrants may be limited in certain circumstances if, upon

exercise, certain holders or any of their affiliates would beneficially own more

than 4.99% of our common stock. This limit may be increased to up to 9.99%

upon no fewer than 60 days’ notice.

PLAN

OF DISTRIBUTION

Placement

Agency Agreement and Subscription Agreements

William

Blair & Company, L.L.C., which we refer to as the placement agent, has

agreed to act as the exclusive placement agent in connection with this offering

subject to the terms and conditions of a placement agency agreement dated as of

July 22, 2010. The placement agent is not purchasing or selling any shares of

common stock or warrants offered by this prospectus supplement, nor is it

required to arrange the purchase or sale of any specific number or dollar amount

of the shares and warrants, but the placement agent has agreed to use its

reasonable efforts to arrange for the sale of all of the shares and warrants

offered hereby. Therefore, we will enter into subscription agreements

directly with investors in connection with this offering and we may not sell the

entire amount of shares and warrants offered pursuant to this prospectus

supplement.

S-13

The

placement agency agreement provides that the obligations of the placement agent

is subject to certain conditions precedent, including, among other things, the

absence of any material adverse change in our change in our business and the

receipt of customary opinions, letters and closing certificates.

The

placement agent proposes to arrange for the sale to one or more purchasers of

the shares and warrants offered pursuant to this prospectus supplement through

the subscription agreements between the purchasers and us. We

negotiated the price for the shares offered in this offering with the

purchasers. The factors considered in determining the price included the recent

market price of our common stock, the general condition of the securities market

at the time of this offering, the history of, and the prospects, for the

industry in which we compete, our past and present operations, and our prospects

for future revenues.

We

have agreed to indemnify the placement agent against liabilities under the

Securities Act of 1933, as amended, and against breaches of our representations

and warranties and covenants in the placement agency agreement. We have also

agreed to contribute to payments the placement agent may be required to make in

respect of such liabilities.

We

have agreed, subject to limited exceptions, for a period of 60 days after the

date of this prospectus supplement, not to, without the prior written consent of

the placement agent, directly or indirectly,

|

|

·

|

offer

to sell, hypothecate, pledge, announce the intention to sell, sell,

contract to sell, sell any option or contract to purchase, purchase any

option or contract to sell, grant any option, right or warrant to purchase

or otherwise transfer or dispose of, directly or indirectly, or establish

or increase a put equivalent position or liquidate or decrease a call

equivalent position within the meaning of Section 16 of the Exchange Act,

with respect to, any shares of common stock, or any securities convertible

into or exercisable or exchangeable for shares of common

stock,

|

|

|

·

|

file

or cause to become effective a registration statement under the Securities

Act relating to the offer and sale of any shares of common stock or

securities convertible into or exercisable or exchangeable for shares of

common stock, or

|

|

|

·

|

enter

into any swap or other agreement that transfers, in whole or in part, any

of the economic consequences of ownership of the common

stock,

|

other

than the issuance of stock options or shares of restricted stock to employees,

directors and consultants pursuant to our stock benefit plans, issuances of

shares of common stock upon the exercise of options disclosed in the

accompanying prospectus or upon the conversion or exchange of convertible or

exchangeable securities disclosed as outstanding in the accompanying prospectus

or the issuance of any shares of common stock as consideration for mergers,

acquisitions, other business combinations, or strategic alliances, occurring

after the date of this prospectus supplement (provided that each recipient of

such shares agrees that all such shares remain subject to these transfer

restrictions), or the purchase or sale of our securities pursuant to a

plan, contract or instruction that satisfies all of the requirements of Rule

10b5-1(c)(1)(i)(B) that was in effect prior to the date of this prospectus

supplement.

In

addition, our officers and directors have agreed, subject to limited exceptions,

for a period of 60 days after the date of this prospectus supplement, not to,

without the prior written consent of the placement agent:

|

|

·

|

sell,

offer to sell, contract or agree to sell, hypothecate, pledge, grant any

option to purchase or otherwise dispose of or agree to dispose of,

directly or indirectly, to file (or participate in the filing of) a

registration statement with the SEC in respect of, or establish or

increase a put equivalent position or liquidate or decrease a call

equivalent position with respect to, any common stock or any other

securities substantially similar to the common stock or securities

convertible or exchangeable into, or exercisable for, common stock;

or

|

|

|

·

|

enter

into any swap or other arrangement that transfers all or a portion of the

economic consequences associated with the ownership of any common

stock.

|

S-14

The

60-day lock-up periods will be extended if (1) we release earnings results or

material news or a material event relating to our company occurs during the last

17 days of the lock-up period, or (2) prior to the expiration of the lock-up

period, we announce that we will release earnings results during the 16-day

period beginning on the last day of the lock-up period. In either case, the

lock-up period will be extended for 18 days after the date of the release of the

earnings results or the occurrence of the material news or material event unless

the placement agents waive such extension.

Fees

The

placement agent will be entitled to a cash fee of 6% of the gross proceeds paid

to us for the shares of common stock which we sell in this offering. We will

also reimburse the placement agents for all reasonable out-of-pocket expenses

incurred by the placement agents in this offering so long as such expenses are

not greater than 8% of the gross proceeds received by the Company in

the offering less the placement agent fees.

The

following table shows the per common stock share and total placement agency fees

we will pay to the placement agents in connection with the sale of the shares

offered pursuant to this prospectus supplement assuming the purchase of all of

the shares of common stock offered hereby:

|

Placement

agent fees per share of common stock

|

$ | 0.396 | ||

|

Total

|

$ | 819,716.83 |

Because

there is no minimum offering amount required as a condition to closing in this

offering, the actual total placement agency fees, if any, are not presently

determinable and may be substantially less than the maximum amount set forth

above. The maximum fees to be received by any member of the Financial Industry

Regulatory Association, or FINRA, or independent broker-dealer may not be

greater than eight percent (8%) of the initial gross proceeds from the sale of

any shares of common stock being offered hereby.

Our

obligation to issue and sell common stock to the purchasers is subject to the

conditions set forth in the subscription agreements entered into with the

purchasers, which may be waived by us at our discretion. A purchaser’s

obligation to purchase shares is subject to the conditions set forth in the

applicable subscription agreement as well, which may be waived by the

purchaser.

We

currently anticipate that the sale of up to 2,069,992 shares of common

stock and warrants to purchase 1,034,996 shares of common stock will be

completed on or about July 28, 2010. We estimate the total offering expenses of

this offering that will be payable by us, excluding the placement agency fees,

will be approximately $125,000, which include legal and printing costs, various

other fees and reimbursement of the placement agents’ expenses.

The

placement agent may be deemed to be an underwriter within the meaning of Section

2(a)(11) of the Securities Act of 1933, as amended, or the Securities Act, and

any fees or commissions received by them and any profit realized on the resale

of securities sold by them while acting as principal might be deemed to be

underwriting discounts or commissions under the Securities Act. As an

underwriter, the placement agent would be required to comply with the

requirements of the Securities Act and the Exchange Act, including, without

limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and

Regulation M under the Exchange Act. These rules and regulations may limit the

timing of purchases and sales of shares of common stock by the placement agents.

Under these rules and regulations, the placement agent:

|

|

·

|

may

not engage in any stabilization activity in connection with our

securities; and

|

|

|

·

|

may

not bid for or purchase any of our securities or attempt to induce any

person to purchase any of our securities, other than as permitted under

the Exchange Act, until it has completed its participation in the

distribution

|

S-15

From time

to time in the ordinary course of their respective businesses, the placement

agent or its affiliates have in the past or may in the future engage in

investment banking and/or other services with us and our affiliates for which

they have or may in the future receive customary fees and expenses.

The

foregoing does not purport to be a complete statement of the terms and

conditions of the placement agency agreement and subscription agreements. Copies

of the placement agency agreement and the subscription agreements will be

included as exhibits to our current report on Form 8-K that will be filed with

the SEC and incorporated by reference into the Registration Statement of which

this prospectus supplement forms a part. See “Where You Can Find Additional

Information” on page 21 of the prospectus.

The

transfer agent for our common stock is Computershare Trust Company.

Our

common stock is traded on the NASDAQ Capital Market under the symbol

“LTBR.”

LEGAL

MATTERS

Gary R.

Henrie, 8275 S. Eastern Ave., Suite 200, Las Vegas, NV 89123, will issue a legal

opinion as to the validity of the issuance of the securities offered under this

prospectus. Certain legal matters with respect to the warrants offered under

this prospectus will be passed upon for us by Pillsbury Winthrop Shaw

Pittman LLP, 2300 N Street, NW, Washington, D.C. 20037-1122. Lowenstein Sandler PC, 65

Livingston Avenue, Roseland, NJ 07068, has served as counsel for the placement

agent.

EXPERTS

The

consolidated financial statements of the Company as of December 31, 2009 and

2008 and for the years ended December 31, 2009 and 2008 incorporated in this

prospectus supplement by reference have been audited by the accounting firm of

Child, Van Wagoner & Bradshaw, PLLC, an independent registered public

accounting firm, as indicated in their report thereon dated March 5, 2010, which

is incorporated by reference herein in reliance upon such firm’s authority as

experts in auditing and accounting.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC

allows us to “incorporate by reference” into this prospectus supplement certain

information that we file with the SEC, which means that we can disclose

important information to you by referring you to those documents. Any

information that we file with the SEC after the date of this prospectus

supplement will automatically update this prospectus supplement. We incorporate

by reference into this prospectus supplement the documents listed below, which

are considered to be a part of this prospectus supplement:

|

|

·

|

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2009,

filed March 16, 2010;

|

|

|

·

|

Our

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2010,

filed on July 22,

2010;

|

|

|

·

|

Our

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2010,

filed on May 13, 2010;

|

|

|

·

|

Our

Current Report on Form 8-K, filed with the SEC on May 6,

2010;

|

S-16

|

|

·

|

Our

Current Report on Form 8-K, filed with the SEC on June 23, 2010;

and

|

|

|

·

|

The

description of our common stock, $0.001 par value per share, contained in

our Registration Statement on Form 8-A, filed on October 8, 2009 pursuant

to Section 12(b) of the Exchange

Act.

|

All

documents that we file with the SEC after the date of this prospectus supplement

pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the

termination of this offering, are incorporated by reference into this prospectus

supplement and will automatically update information in this prospectus

supplement; provided, however, that notwithstanding the forgoing, unless

specifically stated to the contrary, none of the information that we disclose

under Items 2.02 or 7.01 of any Current Report on Form 8-K that we may from time

to time furnish to the SEC will be incorporated by reference into, or otherwise

included in, this prospectus supplement. The information contained in any such

filing will be deemed to be a part of this prospectus supplement, commencing on

the date on which the document is filed.

You may

request a copy of these reports, which we will provide to you at no cost, by

writing or calling us at our mailing address and telephone number: Lightbridge

Corporation, 1600 Tysons Boulevard, Suite 550, McLean, Virginia 22102, Attn:

Investor Relations, telephone: (571) 730-1213.

S-17

PROSPECTUS

$50,000,000

LIGHTBRIDGE

CORPORATION

Common

Stock

Preferred

Stock

Debt

Securities

Warrants

Units

We may

offer, issue and sell from time to time our common stock, preferred stock, debt

securities, warrants or units up to $50,000,000 or its equivalent in any other

currency, currency units, or composite currency or currencies in one or more

issuances. We may offer and sell the securities separately, together or as

units, in separate classes or series, in amounts, at prices and on terms to be

determined at the time of sale. This prospectus provides a general description

of offerings of these securities that we may undertake.

Each time

we sell our securities pursuant to this prospectus, we will provide the specific

terms of such offering in a supplement to this prospectus. The prospectus

supplement may also add, update, or change information contained in this

prospectus. You should read this prospectus and the accompanying prospectus

supplement, together with additional information described under the heading

“Where You Can Find More Information” and “Information Incorporated by

Reference,” before you make your investment decision.

This

prospectus may not be used to offer or sell our securities unless accompanied by

a prospectus supplement. The information contained or incorporated in this

prospectus or in any prospectus supplement is accurate only as of the date of

this prospectus, or such prospectus supplement, as applicable, regardless of the

time of delivery of this prospectus or any sale of our securities.

Our

common stock is listed on the NASDAQ Capital Market under the symbol “LTBR”. On

November 18, 2009, the last reported per share sale price of our common stock

was $5.03.

We may

offer securities through underwriting syndicates managed or co-managed by one or

more underwriters, through agents, or directly to purchasers. The

prospectus supplement for each offering of securities will describe the plan of

distribution for that offering. For general information about the

distribution of securities offered, please see “Plan of Distribution” in this

prospectus.

See

the “Risk Factors” section of our filings with the SEC and the applicable

prospectus supplement for certain risks that you should consider before

investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus or

any prospectus supplement is truthful or complete. Any representation to the

contrary is a criminal offense.

The date

of this prospectus is November 19, 2009

TABLE

OF CONTENTS

Prospectus

|

ABOUT THIS PROSPECTUS

|

1

|

|

USE OF TERMS

|

1

|

|

LIGHTBRIDGE CORPORATION

|

1

|

|

RISK FACTORS

|

3

|

|

FORWARD-LOOKING STATEMENTS

|

3

|

|

USE OF PROCEEDS

|

4

|

|

RATIOS OF EARNINGS TO FIXED

CHARGES

|

4

|

|

DESCRIPTION OF CAPITAL

STOCK

|

5

|

|

DESCRIPTION OF WARRANTS

|

7

|

|

DESCRIPTION OF DEBT

SECURITIES

|

9

|

|

DESCRIPTION OF UNITS

|

18

|

|

PLAN OF DISTRIBUTION

|

19

|

|

LEGAL MATTERS

|

20

|

|

EXPERTS

|

21

|

|

WHERE YOU CAN FIND ADDITIONAL

INFORMATION

|

21

|

|

INCORPORATION OF CERTAIN INFORMATION BY

REFERENCE

|

21

|

i

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities

and Exchange Commission, or SEC, using a “shelf” registration process. Under

this shelf registration process, we may sell our securities described in this

prospectus in one or more offerings up to a total dollar amount of $50,000,000.

Each time we offer our securities, we will provide you with a supplement to this

prospectus that will describe the specific amounts, prices and terms of the

securities we offer. The prospectus supplement may also add, update or change

information contained in this prospectus. This prospectus, together with

applicable prospectus supplements and the documents incorporated by reference in

this prospectus and any prospectus supplements, includes all material

information relating to this offering. Please read carefully both this

prospectus and any prospectus supplement together with additional information

described below under “Where You Can Find More Information” and “Information

Incorporated by Reference.”

You

should rely only on the information contained in or incorporated by reference in

this prospectus and any applicable prospectus supplement. We have not authorized

anyone to provide you with different or additional information. If anyone

provides you with different or inconsistent information, you should not rely on

it. The information contained in this prospectus is accurate only as of the date

of this prospectus, regardless of the time of delivery of this prospectus or any

sale of securities described in this prospectus. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted. You

should assume that the information appearing in this prospectus or any

prospectus supplement, as well as information we have previously filed with the

SEC and incorporated by reference, is accurate as of the date on the front of

those documents only. Our business, financial condition, results of operations

and prospects may have changed since those dates. This prospectus may not be used to

consummate a sale of our securities unless it is accompanied by a prospectus

supplement.

USE

OF TERMS

Except

as otherwise indicated by the context, all references in this prospectus to (i)

“Lightbridge,” “we,” “us,” “our,” “our Company,” or “the Company” are to

Lightbridge Corporation, a Nevada corporation, and its consolidated

subsidiaries; (ii) “Securities Act” are to the Securities Act of 1933, as

amended; and (iii) “Exchange Act” means the Securities Exchange Act of 1934, as

amended.

LIGHTBRIDGE

CORPORATION

We are a

provider of nuclear energy consulting and strategic advisory services and a

developer of proprietary nuclear fuel designs, each of which will be described

in the following sections.

Consulting

and Strategic Advisory Services Business Segment

We are

primarily engaged in the business of assisting commercial and governmental

entities with developing and expanding their nuclear industry capabilities and

infrastructure. We provide integrated strategic advice across a range of

expertise areas including, for example, nuclear reactor procurement and

deployment, reactor and fuel technology, international relations and regulatory

affairs.

Due to

the relatively limited growth in the nuclear energy industry during the 1980’s

and 1990’s, and corresponding limited recruitment into the industry, the cadre

of engineers, managers and other nuclear energy industry experts is aging. In

the nuclear renaissance, we believe that the industry will be challenged in

acquiring and retaining sufficient qualified expertise. Moreover, in countries

studying new nuclear energy programs, the number of qualified nuclear energy

personnel is very limited, and we believe that those countries will need to rely

on significant support from non-domestic service providers and experts to ensure

success in those programs.

Our

emergence in the field of nuclear energy consulting is in direct response to the

need for independent assessments and highly qualified technical consulting

services from countries looking to establish nuclear energy programs, by

providing a blueprint for safe, clean, efficient and cost-effective

non-proliferative nuclear power. We offer full-scope strategic planning and

advisory services for new and growing existing markets. Furthermore, we only

engage with commercial entities and governments that are dedicated to

non-proliferative and transparent nuclear programs.

1

Our

consulting services are expert and relationship based, with particular emphasis

on top-of-mind issues of key decision makers in senior positions within

governments or companies, as well as focus on overall management of nuclear

energy programs. To date, substantially all of our revenues are

derived from our business segment which provides nuclear consulting services to

entities within the United Arab Emirates

Technology

Business Segment

For most

of the past decade we have been engaged in the development of proprietary

nuclear fuel designs which we ultimately intend to introduce for sale into two

markets: (1) nuclear fuel designs for use in commercial nuclear power plants and

(2) nuclear fuel designs for reactor-grade plutonium disposition. In addition,

we have a conceptual nuclear fuel design for weapons-grade plutonium

disposition. These three types of fuel design are primarily for use in existing

or future VVER-1000 light water reactors. We have also been conducting research

and development related to a variant of these nuclear fuel designs for use in

existing pressurized water reactors.

Our

future customers may include nuclear fuel fabricators, nuclear power plants

and/or the U.S. or international governments.

To date,

our operations have been devoted primarily to the development and demonstration

of our nuclear fuel designs, developing strategic relationships within and

outside of the nuclear power industry, securing political and financial support

from the U.S. and Russian governments, and the filing of patent applications

(including related administrative functions).

On August

3, 2009, we entered into an Agreement for Consulting Services with

Areva, pursuant to which we will conduct the first phase of an

investigation of specific topics of thorium fuel cycles in Areva’s light water

reactors, or LWRs. This first phase will focus on providing initial general

results relating to evolutionary approaches to the use of thorium in Areva’s

LWRs, specifically within Areva’s Evolutionary Power Reactor. We will receive

total fees of $550,000 for services provided pursuant to the Consulting

Agreement. The anticipated second phase and further phases of the collaboration,

including a detailed study of evolutionary and longer-term thorium fuel

concepts, will be conducted in accordance with additional collaborative

agreements based upon the results of the first phase.

The first

and second phases of the collaboration between us and Areva are being conducted

with the intention of future cooperation agreements between the two parties in

order to develop and set up new products and technologies related to thorium

fuel concepts. Areva’s use of Thorium Power’s intellectual property for

commercial purposes or any purpose other than as specified in the Agreement

would be separately negotiated on a royalty basis. The initial term of the

Agreement for Consulting Services is 12 months, with an additional 14 month term

if the parties decide to perform a preliminary review of thermal hydraulic

characteristics and fuel behavior for the selected concepts for an EPR 18-month

equilibrium cycle.

The

Agreement for Consulting Services replaces and supersedes the Initial

Collaborative Agreement we entered into with Areva on July 23, 2009, which we

reported on SEC Form 8-K filed on July 23, 2009.

On August

3, 2009, we entered into a Collaborative Framework Agreement with Areva, as the

next step contemplated by the Initial Collaborative Agreement and the Agreement

for Consulting Services, pursuant to which we will establish a joint

steering committee with Areva, consisting of two employees from each

party. The steering committee will be responsible for reviewing

project proposals, will be empowered to make scientific and/or technical

decisions and to allocate the resources required to implement future

collaborative projects. All research and development activities