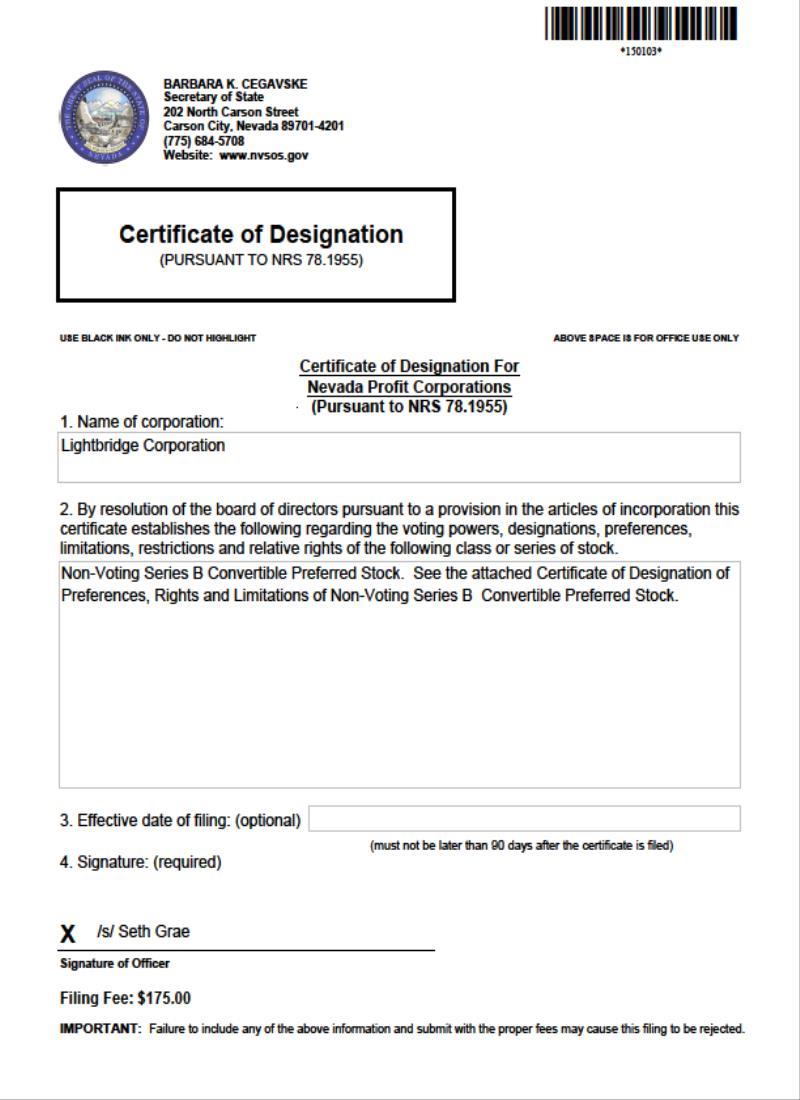

CERTIFICATE OF DESIGNATION

Published on January 30, 2018

EXHIBIT 3.1

| 1 |

LIGHTBRIDGE CORPORATION

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

NON-VOTING SERIES B CONVERTIBLE PREFERRED STOCK

PURSUANT TO SECTION 78.1955 OF THE

NEVADA REVISED STATUTE

The undersigned, Seth Grae, does hereby certify that:

1. He is the President and Chief Executive Officer of Lightbridge Corporation, a Nevada corporation (the “Corporation”).

2. The Corporation is authorized to issue 10,000,000 shares of preferred stock.

3. The following resolutions were duly adopted by the board of directors of the Corporation (the “Board of Directors”):

WHEREAS, the articles of incorporation of the Corporation (the “Articles”) provides for a class of its authorized stock known as preferred stock, consisting of 10,000,000 shares, $0.001 par value per share, issuable from time to time in one or more series;

WHEREAS, the Articles authorizes the Board of Directors to fix and determine the designations, qualifications, preferences, limitations and terms of the shares of any series of preferred stock; and

WHEREAS, it is the desire of the Board of Directors, pursuant to its authority as aforesaid, to fix and determine designations, qualifications, preferences, limitations and terms relating to a series of the preferred stock, which shall consist of 2,666,666 shares of the preferred stock which the Corporation has the authority to issue, as follows:

NOW, THEREFORE, BE IT RESOLVED, that the Board of Directors does hereby provide for the issuance of a series of preferred stock for cash or exchange of other securities, rights or property and does hereby fix and determine the rights, preferences, restrictions and other matters relating to such series of preferred stock as follows:

TERMS OF PREFERRED STOCK

Section 1. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 of the Securities Act.

“Business Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Call Option” shall have the meaning set forth in Section 7(a).

| 2 |

“Call Option Notice” shall have the meaning set forth in Section 7(b).

“Common Stock” means the Corporation’s common stock, par value $0.001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed.

“Common Stock Event” shall have the meaning set forth in Section 6(e).

“Conversion Date” shall have the meaning set forth in Section 6(b)(ii).

“Conversion Price” shall have the meaning set forth in Section 6(a).

“Conversion Shares” means, collectively, the shares of Common Stock issuable upon conversion of the shares of Preferred Stock in accordance with the terms hereof.

“Dividend Payment Date” shall have the meaning set forth in Section 3(a).

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Holders” shall have the meaning given such term in Section 2.

“Investors Rights Agreement” means the Investors Rights Agreement, dated January 30, 2018, between the Corporation and the original Holders.

“Liquidation” shall have the meaning set forth in Section 5.

“Liquidation Preference” shall have the meaning set forth in Section 2, as the same may be increased pursuant to Section 3.

“Mandatory Conversion Notice” shall have the meaning set forth in Section 6(c).

“Mandatory Conversion Notice Date” shall have the meaning set forth in Section 6(c).

“Nasdaq” means the Nasdaq Stock Market LLC.

“Notice of Conversion” shall have the meaning set forth in Section 6(b)(ii).

“Original Issue Date” shall mean, with respect to any shares of Preferred Stock, the date on which such share of Preferred Stock was issued by the Corporation.

“Permitted Transfer” shall have the meaning set forth in Section 8.

“Permitted Transferee” shall have the meaning set forth in Section 8.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Preferred Stock” shall have the meaning set forth in Section 2.

“Purchase Agreement” means the Securities Purchase Agreement, dated January 18, 2018, between the Corporation and the original Holders, as amended, modified or supplemented from time to time in accordance with its terms.

“Redemption Date” shall mean the date upon which a redemption effected pursuant to the exercise of a Call Option shall be consummated.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

| 3 |

“Series A Preferred Stock” means the Non-Voting Series A Convertible Preferred Stock of the Corporation.

“Trading Day” means a day on which the principal Trading Market is open for business.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, OTCQB or OTCQX (or any successors to any of the foregoing).

“Trading Price” means the average closing price per share of Common Stock on the primary Trading Market for the Common Stock for a thirty (30) Trading Day period, starting with the opening of trading on the thirty-first (31st) Trading Day prior to the closing of trading on the Trading Day prior to the calculation date, as reported by Bloomberg Finance L.P.

“Transaction Documents” means this Certificate of Designation, the Purchase Agreement, the Investors Rights Agreement, all exhibits and schedules thereto and hereto and any other documents or agreements executed in connection with the transactions contemplated pursuant to the Purchase Agreement.

“Transfer” shall have the meaning set forth in Section 8.

Section 2. Designation, Amount and Par Value. The series of preferred stock shall be designated as Non-Voting Series B Convertible Preferred Stock (the “Preferred Stock”) and the number of shares so designated shall be 2,666,666 (which shall not be subject to increase, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Preferred Stock, without the written consent of all of the holders of the Preferred Stock (each, a “Holder” and collectively, the “Holders”)). Each share of Preferred Stock shall have a par value of $0.001 per share and an original issue price of $1.50 per share (the “Liquidation Preference”), subject to increase set forth in Section 3 below.

Section 3. Dividends.

(a) Dividends in Kind. From and after the Original Issue Date of any share of Preferred Stock, cumulative dividends on such Preferred Stock shall accrue, whether or not declared by the Board of Directors and whether or not there are funds legally available for the payment of dividends, on a daily basis in arrears at the rate of 7% per annum on the sum of the Liquidation Preference thereof, payable quarterly last day of March, June, September and December of each calendar year beginning on the first such date after the Original Issue Date and on each Conversion Date (with respect only to Preferred Stock then being converted) (each such date, a “Dividend Payment Date”). All accrued dividends shall be paid in kind by increasing the Liquidation Preference of the Preferred Stock, in an amount equal to the accrued but unpaid interest due to a Holder on the Dividend Payment Date. All accrued and accumulated dividends on the Preferred Stock shall be prior and in preference to any dividend on the Common Stock or other equity securities of the Company, including (for the avoidance of doubt) the Series A Preferred Stock, and shall be fully declared and paid before any dividends are declared and paid, or any other distributions or redemptions are made, on the Common Stock or other equity securities of the Company, including (for the avoidance of doubt) the Series A Preferred Stock, other than to (a) declare or pay any dividend or distribution payable on the Common Stock in shares of Common Stock or (b) repurchase Common Stock held by employees or consultants of the Corporation upon termination of their employment or services pursuant to agreements providing for such repurchase.

(b) Dividend Calculations. Dividends on the Preferred Stock shall be calculated on the basis of a 360-day year, consisting of twelve 30 calendar day periods, and shall accrue daily commencing on the Original Issue Date.

| 4 |

(c) Participating Dividends. In addition to the dividends accruing on the Preferred Stock pursuant to Section 3(a) hereof, if the Corporation declares or pays a dividend or distribution on the Common Stock or Series A Preferred Stock, whether such dividend or distribution is payable in cash, securities or other property, including the purchase or redemption by the Corporation or any of its subsidiaries of shares of Common Stock or Series A Preferred Stock for cash, securities or property, but excluding (i) any dividend or distribution payable on the Common Stock in shares of Common Stock and (ii) any repurchases of Common Stock held by employees or consultants of the Corporation upon termination of their employment or services pursuant to agreements providing for such repurchase, the Corporation shall simultaneously declare and pay a dividend on the Preferred Stock on a pro rata basis with the Common Stock or Series A Preferred Stock, as applicable, and in the case of dividends or distributions on the Common Stock, determined on an as-converted basis assuming all shares of Preferred Stock had been converted pursuant to Section 6 as of immediately prior to the record date of the applicable dividend (or if no record date is fixed, the date as of which the record holders of Common Stock entitled to such dividends are to be determined).

Section 4. Voting Rights; Protective Provisions.

(a) General. Except as otherwise required by law, the Preferred Stock shall have no voting rights.

(b) Protective Provisions. As long as 666,667 shares of Preferred Stock, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Preferred Stock, are outstanding, except for clause (10) below, which shall require that at least 1,333,334 shares of Preferred Stock, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Preferred Stock, are outstanding, the Corporation shall not either directly or indirectly by amendment, merger, consolidation or otherwise, do any of the following without (in addition to any other vote required by law or the Articles) the written consent or affirmative vote of the Holders of at least a majority of the outstanding shares of Preferred Stock:

(1) alter or change the rights, preferences or privileges of the Preferred Stock;

(2) increase or decrease (other than by redemption or conversion) the authorized number of shares of Preferred Stock;

(3) amend or waive any provision of the Articles or bylaws of the Corporation;

(4) authorize, create, issue, or reclassify any existing security into any class of equity security that is senior or pari passu to the Preferred Stock;

(5) repurchase or redeem Common Stock except from employees, officers, directors, or consultants upon termination of their employment or other relationship or in accordance with any existing repurchase or redemption program that has been approved by the board of directors;

(6) declare or pay any dividend other than a dividend payable solely in stock or other securities of the Corporation;

(7) acquire any entity (regardless of the structure of any such acquisition, including if such acquisition is structured as a license, lease, merger, reorganization, acquisition of assets or equity or other business combination or similar corporate transaction) for a consideration of $3 million or more;

(8) materially alter the general nature of the business of the Corporation;

(9) enter into any sale, license, lease or other disposition of assets of the Corporation having a book value of at least $10 million that is effected outside of the ordinary course of the business of the Corporation;

| 5 |

(10) effect any event for which the Liquidation Preference would become payable; or

(11) enter into any equity line of credit after the Corporation shall have raised an amount equal to or in excess of $5 million through the issuance of equity securities or securities convertible into equity securities on or after the date of the Purchase Agreement, including proceeds from the sale of the Preferred Stock.

Section 5. Liquidation. Upon any liquidation, dissolution, or winding down of the Corporation (a “Liquidation”), the Holders shall be entitled to receive out of the assets, whether capital or surplus, of the Corporation an amount equal to the Liquidation Preference, plus any accrued and unpaid dividends thereon, for each share of Preferred Stock before any distribution or payment shall be made to the holders of Common Stock or Series A Preferred Stock, and if the assets of the Corporation shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the Holders shall be ratably distributed among the Holders in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full. The Corporation shall mail written notice of any such Liquidation, not less than 10 days prior to the payment date stated therein, to each Holder.

Section 6. Conversion. The outstanding shares of Preferred Stock shall be convertible into Common Stock as follows:

(a) Conversion Price. The conversion price for the Preferred Stock shall equal $1.50, subject to adjustment herein (the “Conversion Price”).

(b) Optional Conversion.

(1) Each share of Preferred Stock shall be convertible, at any time and from time to time from and after the Original Issue Date at the option of the Holder thereof and without the payment of additional consideration, subject to applicable Trading Market rules and the limitations set forth in the Investor Rights Agreement, into that number of shares of Common Stock determined by dividing the Liquidation Preference of such share of Preferred Stock by the Conversion Price.

(2) Each holder of Preferred Stock who elects to convert the same into shares of Common Stock shall give written notice to the Corporation by providing the Corporation with the written notice (a “Notice of Conversion”). Each Notice of Conversion shall specify the number of shares of Preferred Stock to be converted, the number of shares of Preferred Stock owned prior to the conversion at issue, the number of shares of Preferred Stock owned subsequent to the conversion at issue and the date on which such conversion is to be effected, which date may not be prior to the date the applicable Holder delivers by facsimile such Notice of Conversion to the Corporation (such date, the “Conversion Date”). Thereupon, the Corporation shall promptly deliver the Conversion Shares required to be delivered by the Corporation to such Holder. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such delivery of shares of Common Stock, and the person entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder of such shares of Common Stock on such date.

(c) Mandatory Conversion.

(1) Notwithstanding anything herein to the contrary, if at any time the Trading Price (i) is greater than $5.4902 per share before August 2, 2019 or (ii) is greater than $8.2353 per share, the Corporation may deliver a written notice to all Holders (a “Mandatory Conversion Notice” and the date such notice is delivered to all Holders, the “Mandatory Conversion Notice Date”) to cause each Holder to convert all or part of such Holder’s Preferred Stock (as specified in such Mandatory Conversion Notice) plus all accrued but unpaid dividends thereon. The Corporation shall promptly deliver the Conversion Shares required to be delivered by the Corporation under this Section 6(c) to each Holder. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such delivery of shares of Common Stock, and the person entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder of such shares of Common Stock on such date. If any shares of Series A Preferred Stock are then outstanding, the Corporation may only deliver a Mandatory Conversion Notice if the Corporation also causes the concurrent mandatory conversion of all or part of the Series A Preferred Stock pursuant to the terms thereof in the same proportion as the percentage of outstanding Preferred Stock being mandatorily converted.

| 6 |

(2) If the Corporation at any time causes the mandatory conversion of all or part of the outstanding Series A Preferred Stock pursuant to the terms thereof, the Corporation shall cause a concurrent mandatory conversion of the Preferred Stock in the same proportion as the percentage of outstanding Series A Preferred Stock being mandatorily converted.

(d) Fractional Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of the Preferred Stock. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, the Corporation shall at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Conversion Price or round up to the next whole share.

(e) Adjustment Upon Common Stock Event. Upon the happening of a Common Stock Event (as hereinafter defined), the Conversion Price of the Preferred Stock shall, simultaneously with the happening of such Common Stock Event, be adjusted by multiplying the Conversion Price of the Preferred Stock in effect immediately prior to such Common Stock Event by a fraction, (i) the numerator of which shall be the number of shares of Common Stock issued and outstanding immediately prior to such Common Stock Event, and (ii) the denominator of which shall be the number of shares of Common Stock issued and outstanding immediately after such Common Stock Event, and the product so obtained shall thereafter be the Conversion Price for the Preferred Stock. The Conversion Price for the Preferred Stock shall be readjusted in the same manner upon the happening of each subsequent Common Stock Event. As used herein, the term “Common Stock Event” shall mean (i) the issue by the Corporation of additional shares of Common Stock as a dividend or other distribution on outstanding Common Stock, (ii) a subdivision of the outstanding shares of Common Stock into a greater number of shares of Common Stock, or (iii) a combination of the outstanding shares of Common Stock into a smaller number of shares of Common Stock.

Section 7. Call Option.

(a) The Corporation shall have the option (the “Call Option”) at any time after August 2, 2019 to redeem some or all of the outstanding Preferred Stock for cash, for an amount equal to the Liquidation Preference, plus the amount of any accrued but unpaid dividends, of the Preferred Stock being redeemed. If any shares of Series A Preferred Stock are then outstanding, the Corporation may only exercise the Call Option if the Corporation also concurrently redeems all or part of the Series A Preferred Stock pursuant to the terms thereof in the same proportion as the percentage of outstanding Preferred Stock being redeemed. If the Corporation at any time redeems all or part of the outstanding Series A Preferred Stock pursuant to the terms thereof, the Corporation shall concurrently redeem the Preferred Stock in the same proportion as the percentage of outstanding Series A Preferred Stock being redeemed.

(b) The exercise of the Call Option by the Corporation shall be subject to the transmission of a written notice of the exercise of the Call Option to the Holders (the “Call Option Notice”) 30 days prior to the applicable Redemption Date which shall specify the number of shares Preferred Stock being redeemed.

| 7 |

(c) With respect to exercises of the Call Option, the Corporation shall remit the applicable cash consideration in one installment to the Holder between the 31st and 60th day after delivery of the Call Option Notice.

(d) The Holder shall maintain the right to convert the Preferred Stock into shares of Common Stock pursuant to Section 6(a) prior to the Redemption Date.

Section 8. Transfer Restrictions. No Holder of Preferred Stock may sell, assign, transfer, pledge, encumber or in any manner dispose of the shares of Preferred Stock or any right or interest therein (including without limitation a voting proxy), whether voluntarily or by operation of law, or by gift or otherwise (a “Transfer”), other than by means of a Permitted Transfer. Any Transfer, or purported Transfer, of Preferred Stock of the Corporation other than a Permitted Transfer shall be null and void, and of no force or effect; provided that the Board of Directors may at its sole discretion waive any or all of the foregoing conditions through prior written consent. The only transaction that is a “Permitted Transfer” is a Transfer that meets the following conditions: (i) the Transfer by a Holder must be to an Affiliate of such Holder (a “Permitted Transferee”) or to the Corporation, (ii) if the Transfer is to a Permitted Transferee, such Permitted Transferee must become a party to that certain Investors Rights Agreement, and (iii) the Transfer must comply with all applicable securities laws including, without limitation, the federal securities laws of the United States.

Section 9. Miscellaneous.

(a) Notices. Any and all notices or other communications or deliveries to be provided by the Holders hereunder including, without limitation, any Notice of Conversion, shall be in writing and delivered personally, by facsimile, or sent by a nationally recognized overnight courier service, addressed to the Corporation, Attention: Seth Grae, 11710 Plaza America Drive, Suite 2000, Reston, VA 20190, facsimile number (571) 730-1260, or such other facsimile number or address as the Corporation may specify for such purposes by notice to the Holders delivered in accordance with this Section. Any and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered personally, by facsimile, or sent by a nationally recognized overnight courier service addressed to each Holder at the facsimile number or address of such Holder appearing on the books of the Corporation, or if no such facsimile number or address appears on the books of the Corporation, at the principal place of business of such Holder, as set forth in the Purchase Agreement. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number set forth in this Section prior to 5:30 p.m. (New York City time) on any date, (ii) the next Trading Day after the date of transmission, if such notice or communication is delivered via facsimile at the facsimile number set forth in this Section on a day that is not a Trading Day or later than 5:30 p.m. (New York City time) on any Trading Day, (iii) the second Trading Day following the date of mailing, if sent by U.S. nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given.

(b) Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Certificate of Designation shall be governed by and construed and enforced in accordance with the internal laws of the State of Nevada, without regard to the principles of conflict of laws thereof. Each party hereto hereby irrevocably waives, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Certificate of Designation or the transactions contemplated hereby. If any party shall commence an action or proceeding to enforce any provisions of this Certificate of Designation, then the prevailing party in such action or proceeding shall be reimbursed by the other party for its attorneys’ fees and other costs and expenses incurred in the investigation, preparation and prosecution of such action or proceeding.

(c) Waiver. Any waiver by the Corporation or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation or a waiver by any other Holders. The failure of the Corporation or a Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designation on any other occasion. Any waiver by the Corporation or a Holder must be in writing.

| 8 |

(d) Severability. If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation shall remain in effect, and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates the applicable law governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under applicable law.

(e) Next Business Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

(f) Headings. The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not be deemed to limit or affect any of the provisions hereof.

(g) Status of Converted or Redeemed Preferred Stock. Shares of Preferred Stock may only be issued pursuant to the Purchase Agreement. If any shares of Preferred Stock shall be converted, redeemed or reacquired by the Corporation, such shares shall resume the status of authorized but unissued shares of preferred stock and shall no longer be designated as Non-Voting Series B Convertible Preferred Stock.

RESOLVED, FURTHER, that the president or any vice-president, and the secretary or any assistant secretary, of the Corporation be and they hereby are authorized and directed to prepare and file this Certificate of Designation of Preferences, Rights and Limitations in accordance with the foregoing resolution and the provisions of Nevada law.

*****

(Signature page follows)

| 9 |

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Designation this 29th day of January, 2018.

| By: |

/s/ Seth Grae |

||

|

|

Name: |

Seth Grae |

|

| Title: | President and Chief Executive Officer |

|

10 |