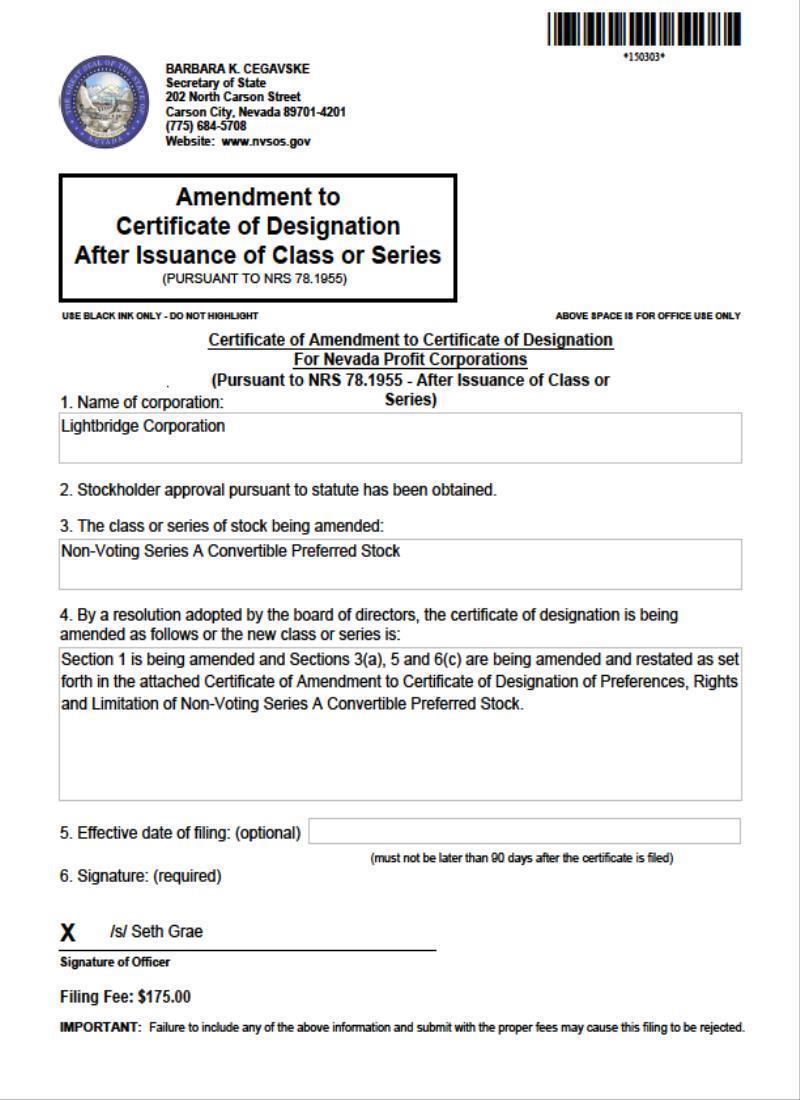

CERTIFICATE OF AMENDMENT

Published on January 30, 2018

EXHIBIT 3.2

| 1 |

CERTIFICATE OF AMENDMENT

TO

CERTIFICATE OF DESIGNATION OF PREFERENCES, RIGHTS AND LIMITATIONS

OF

NON-VOTING SERIES A CONVERTIBLE PREFERRED STOCK

PURSUANT TO SECTION 78.1955 OF THE

NEVADA REVISED STATUTE

| 1. | Name of corporation: Lightbridge Corporation |

|

|

|

| 2. | Stockholder approval pursuant to the statute and as required by Section 4(b) of the Certificate of Designations has been obtained. |

|

|

|

| 3. | The class or series of stock being amended is the Corporation’s Non-Voting Series A Convertible Preferred Stock. |

|

|

|

| 4. | By a resolution adopted by the board of directors, the Certificate of Designation of Preferences, rights and Limitations of Non-Voting Series A Convertible Preferred Stock (the “Certificate”) is being amended as follows: |

|

|

(a) | Section 1 of the Certificate is hereby amended to include the following defined term in the appropriate location in alphabetical order: |

|

|

|

|

|

|

|

““Series B Preferred Stock” means the Non-Voting Series B Convertible Preferred Stock of the Corporation.

“Trading Price” means the average closing price per share of Common Stock on the primary Trading Market for the Common Stock for a thirty (30) Trading Day period, starting with the opening of trading on the thirty-first (31st) Trading Day prior to the closing of trading on the Trading Day prior to the calculation date, as reported by Bloomberg Finance L.P.”” |

|

|

(b) | Section 3(a) of the Certificate is hereby amended and restated in its entirety as follows: |

|

|

|

|

|

|

|

“Dividends in Kind. From and after the Original Issue Date of any share of Preferred Stock, cumulative dividends on such Preferred Stock shall accrue, whether or not declared by the Board of Directors and whether or not there are funds legally available for the payment of dividends, on a daily basis in arrears at the rate of 7% per annum on the sum of the Liquidation Preference thereof, payable quarterly on the last day of March, June, September and December of each calendar year beginning on the first such date after the Original Issue Date and on each Conversion Date (with respect only to Preferred Stock then being converted) (each such date, a “Dividend Payment Date”). All accrued dividends shall be paid in kind by increasing the Liquidation Preference of the Preferred Stock, in an amount equal to the accrued but unpaid interest due to a Holder on the Dividend Payment Date. All accrued and accumulated dividends on the Preferred Stock shall be prior and in preference to any dividend on the Common Stock or other equity securities, except that the Preferred Stock shall be junior to the Series B Preferred Stock, of the Company and shall be fully declared and paid before any dividends are declared and paid, or any other distributions or redemptions are made, on the Common Stock or other equity securities of the Company, except that the Preferred Stock shall be junior to the Series B Preferred Stock, other than to (a) declare or pay any dividend or distribution payable on the Common Stock in shares of Common Stock or (b) repurchase Common Stock held by employees or consultants of the Corporation upon termination of their employment or services pursuant to agreements providing for such repurchase.” |

| 2 |

|

|

(c) | Section 5 of the Certificate is hereby amended and restated in its entirety as follows: |

|

|

|

|

|

|

|

“Liquidation. Upon any liquidation, dissolution, or winding down of the Corporation (a “Liquidation”), following any required payments to the Series B Preferred Stock, the Holders shall be entitled to receive out of the assets, whether capital or surplus, of the Corporation an amount equal to the Liquidation Preference, plus any accrued and unpaid dividends thereon, for each share of Preferred Stock before any distribution or payment shall be made to the holders of Common Stock, and if following any required payments to the Series B Preferred Stock the assets of the Corporation shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the Holders shall be ratably distributed among the Holders in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full. The Corporation shall mail written notice of any such Liquidation, not less than 10 days prior to the payment date stated therein, to each Holder.” |

|

|

(d) | Section 6(c) of the Certificate is hereby amended and restated in its entirety as follows: |

|

|

|

|

|

|

|

“Mandatory Conversion. Notwithstanding anything herein to the contrary, if at any time the Trading Price (i) is greater than two times the Conversion Price before the third anniversary of the Original Issue Date or (ii) is greater than three times the Conversion Price, the Corporation may deliver a written notice to all Holders (a “Mandatory Conversion Notice” and the date such notice is delivered to all Holders, the “Mandatory Conversion Notice Date”) to cause each Holder to convert all or part of such Holder’s Preferred Stock (as specified in such Mandatory Conversion Notice) plus all accrued but unpaid dividends thereon. The Corporation shall promptly deliver the Conversion Shares required to be delivered by the Corporation under this Section 6(c) to each Holder. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such delivery of shares of Common Stock, and the person entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder of such shares of Common Stock on such date.” |

|

|

EXCEPT AS AMENDED ABOVE, the Certificate of Designations shall remain in full force and effect. |

| 5. | Effective date of filing: (optional) |

| 3 |

| 6. | Signature: |

|

|

|

|

|

/s/ Seth Grae |

|

|

|

Name: |

Seth Grae |

|

|

Title: |

Chief Executive Officer |

|

|

4 |